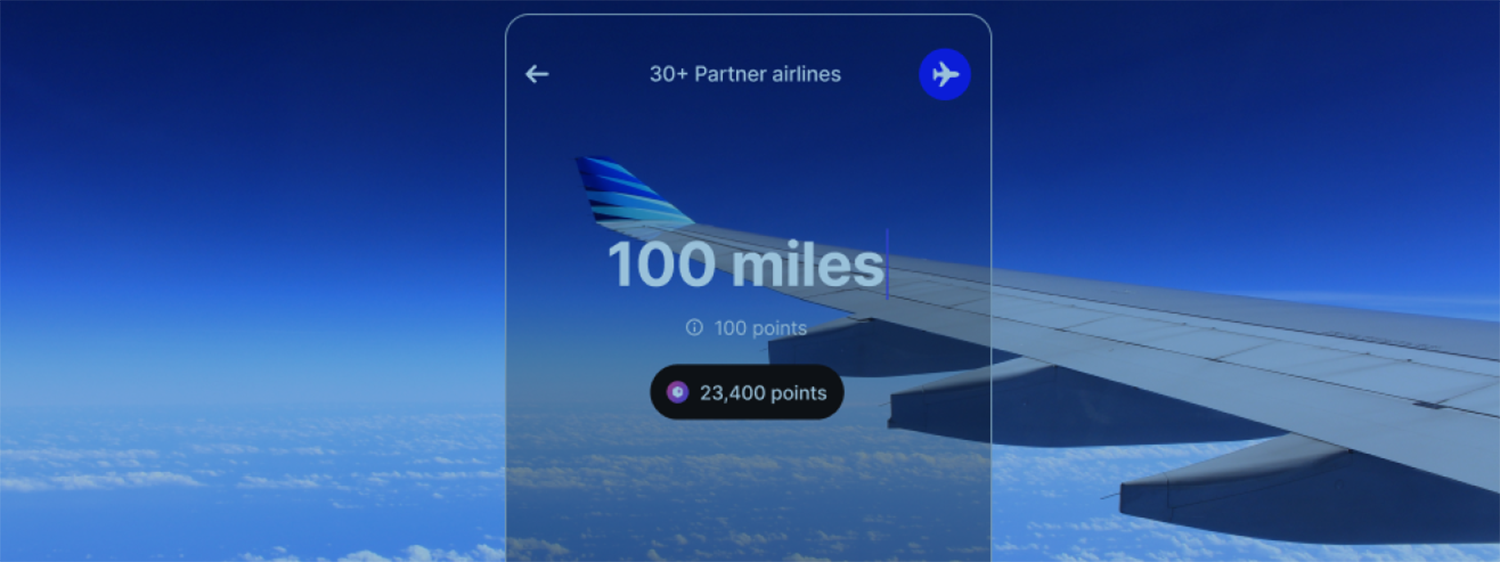

OCBC Securities has unveiled A.I. Oscar, Singapore’s first AI-powered stock-picker, aiming to triple the number of active young investors. A.I. Oscar (OCBC Securities’ Customer Artificial-Intelligence Radar) predicts stock price movements and generates personalized stock ideas. Following a successful pilot from October 2023 to April 2024, it now includes stocks from Hong Kong and the U.S., in addition to Singapore stocks.

A.I. Oscar uses deep learning algorithms to analyze individual trading patterns, risk appetite, past activity, and demographics. Each week, it curates a list of 15 personalized stocks from the Singapore, Hong Kong, and U.S. exchanges, tailored to meet investor preferences.

This tool is especially beneficial for young, self-directed investors. In 2023, 97% of trades by customers under 35 were made through digital platforms without broker assistance. During the pilot, trading activity among young investors increased by 50%. Over half of all new trading accounts in 2023 were opened by this demographic. To meet growing demand, OCBC Securities aims to triple the number of active young investors in the next three years.

A.I. Oscar was developed by OCBC’s Group Data Office and trading strategists, using neural networks trained on data from over 4,000 stocks across major exchanges. This dataset, updated daily, includes a decade’s worth of stock fundamentals, macroeconomic factors, market patterns, and technical indicators.

Wilson He, Managing Director of OCBC Securities, noted that A.I. Oscar helps investors quickly distill relevant information into actionable ideas. The launch of A.I. Oscar reflects OCBC’s commitment to digital transformation, building on previous successes like OCBC Wingman, an AI bot that assists developers.

With A.I. Oscar, OCBC Securities is poised to set a new standard in using AI to enhance financial services, empowering the next generation of investors.