The Commonwealth Bank of Australia (CBA), a leading force in the Australian banking sector, has unveiled an array of innovative products and services tailored to meet the diverse needs of its business customers. This includes CommBank Yello for Business.

A new era of business banking

Mike Vacy-Lyle, CBA’s Group Executive Business Banking, emphasized the bank's dedication to innovation. "As Australia’s leading business bank, we are committed to developing innovative products that do more for our customers, meet more of their needs, and provide a single, holistic experience to eliminate confusion and complexity from their banking."

Introducing CommBank Yello for business

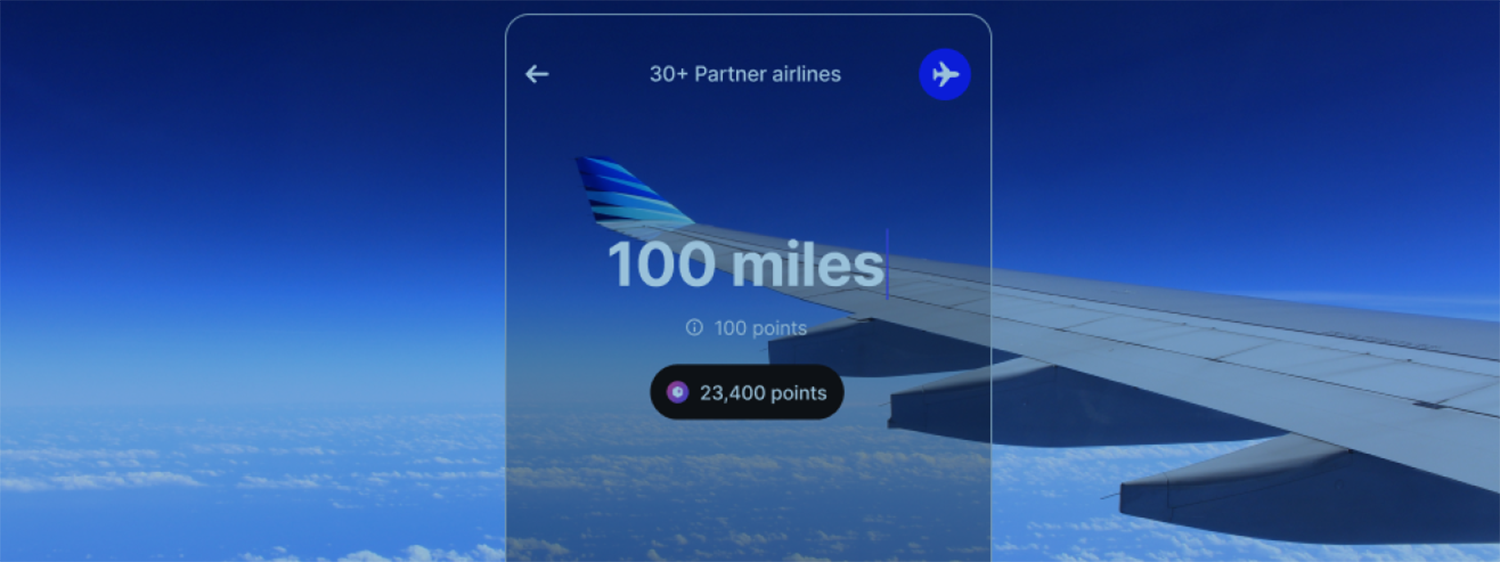

A standout feature of CBA's new offerings is the expansion of CommBank Yello, one of Australia’s largest customer recognition programs, to include small and medium business enterprises (SMEs). Initially launched in 2023, CommBank Yello has been a resounding success among retail customers, delivering approximately $400 million in value annually.

Eligible business customers will soon benefit from this program, gaining access to exclusive offers, discounts, and valuable perks. These benefits will span various business needs, including travel, technology hardware, business software, telecommunications, and workwear.

"CommBank Yello for business is designed to reward and recognize our customers for banking with CBA. We have seen a great response from retail customers who have utilized these personal offers, so it’s exciting to be able to soon welcome business customers to the program," said Vacy-Lyle.

Rollout and future prospects

CommBank Yello will be progressively rolled out to business customers in the upcoming months, marking a significant step in CBA’s mission to provide superior value and service to Australian businesses.

With these new developments, CBA continues to lead the way in reimagining business banking, ensuring that their customers receive not only financial services but also a comprehensive support system to thrive in their respective industries.