The Qorus Open Finance community is a unique platform and the only community where we find ways to connect bankers and insurers with fintech players. This community is providing a forum for fintechs and FIs to meet and see how they can work together. As part of the whole community program, we’ll be holding three dedicated newtech challenge competitions involving the best fintechs in selected areas of open finance (Payments, Inside Data & Decentralized Finance and Insurtech).

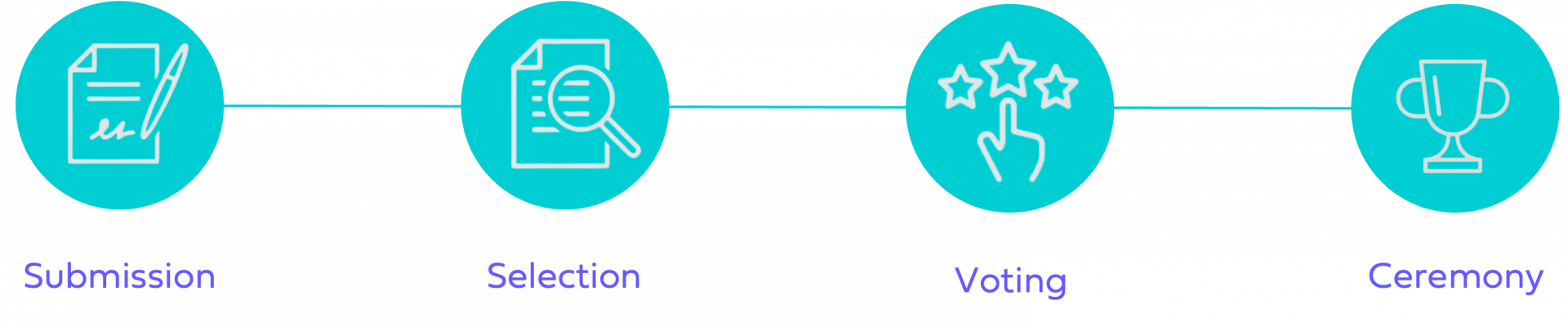

Awards process

The first awards category recognizes the most influential initiatives and ideas in payments. Winners will be selected by their peers through an independent and thorough judging process and will be announced at the virtual awards ceremony on 14 December 2022.

Our internal selection committee has identified the leading fintech companies for the payment challenge, offering an opportunity for top-notch paytechs to showcase their most impactful projects. The nominees have presented their work and projects in a series of articles available on the Qorus website.

Discover the nominees

- OneStep Financial which streamlines the $8.6 bn world of complex corporate incentive payments using fiat DLT Cash.

- Wallet Factory and their Wallet apps and highly personalized customer loyalty programs for businesses from all around the globe, especially where financial inclusion is an issue

- Libeo which enables companies to easily centralize bills, approve them as a team and pay them, from any bank and in one click.

- Token and their whitelabel-ready platform which is built to enable PSPs, gateways and acquirers to easily launch and scale account-to-account payment propositions.

- Unbanked and their fintech platform which provides B2B2C services for other Web3 companies – including 5-minute customer signup, buy/sell crypto, debit cards, and rewards capabilities.

- Modulr and their embedded payments platform, which enables businesses to build accounts and payments directly into their own platforms simply and effectively.

- M2P which embeds fintech in core business offerings, acting as a reliable tech layer between banks, fintechs, and financial institutions

Voting

Submissions are closely reviewed by our selection committee who pick top nominees for each category that are then voted on by our entire community!

Votes coming from the Awards Jury, which comprises senior executives from across the world, will represent 50% of the global score. Qorus members and non-members' votes account for the remaining 50%. Winners are awarded by their peers, with a rigorous, independent process ensuring the credibility of the awards.

Both the Jury Committee and Qorus members as well as non-members can vote for the winners by visiting the dedicated voting page and selecting their top three fintechs keeping in mind the following criteria:

- Originality – Why is the solution different? How inventive, innovative, unique and distinguished is the solution in the market?

- Internationality – Performance at the cross-country level, the degree of internalization

- Business potential – Pain solver: How big and important is the business problem and the level of pain being solved? Is this solution going to solve it at scale?

- Impact – Traction: Is the solution capable of generating significant revenue and having strong traction?

- Wow factor: How excited are you about the projects?

Voting for the Payment Challenge awards starts on 2 December and closes on 11 December 2022. The winners will be announced at the virtual ceremony held on 14 December at 3pm CET.