Banking is undergoing a seismic shift—more transformation has happened in the last decade than in the entire century before it. In this era of relentless disruption, the industry needs bold visionaries—lighthouses of change—who will not just adapt but define the future of banking and shape what Next-Gen banking looks like.

The Qorus-Infosys Finacle Banking Innovation Awards is a global competition that showcases the groundbreaking and effective Next-Gen innovations that are taking advantage of emerging technologies and responding to the disruption and opportunities in banking. Over the years, these awards have become the industry's benchmark for excellence and the awards ceremony is recognized as the premier annual gathering of banking innovators and their ideas worldwide.

This year, Qorus and Infosys Finacle are proud to partner once again to celebrate outstanding banking innovations, and make the awards even bigger and better! There is no charge to participate, and winners are determined by a rigorous, independent judging and voting process, so that the brightest ideas and boldest innovations take center stage.

Submissions that did not win at the Global Awards will also be considered later for the Qorus Regional Awards

Are you looking for information? Do you have a question? To find out all about the Qorus Innovation Awards in banking or insurance, join us on the Innovation Awards Hub

Why enter?

• Showcase how your bank is spearheading Next-Gen innovations right now

• Help promote a culture of innovation in banking

• Achieve the recognition of your colleagues

• Be acknowledged by your industry peers

• Gain public acclaim for your organization as an innovation leader

• Network with other executives who are driving innovation

• Benchmark your innovation against those of other bankers

• Be inspired by the creativity and boldness of your peers

Our criteria

An innovation committee shortlists the best innovation in each category based on 4 criteria:

Originality: The uniqueness of the idea in the marketplace and its potential as a gamechanger.

Impact: The innovation’s capacity to generate a superior, long-term competitive edge. This includes KPIs such as RoI, NPS, cost reduction, churn rate, employee engagement score, customer lifetime value (CLV), time reduction, carbon footprint, etc.

Universality: The innovation’s potential to be relevant and/or adapted for use in other markets, or even industries.

Form quality: A detailed description of the project in its various phases, its results, and the addition of presentation slides, videos or images to visualize and better understand the project.

Key dates

Categories

Business Model Innovation

Creative new products and initiatives that transform the bank’s business model to expand or redefine its role in the evolving ecosystem. This category aims to acknowledge banks that have spearheaded transformative efforts to compete in the realm of "new-age banking". This includes scaling novel models like a digital-first proposition, embracing embedded finance, marketplace banking, super apps, BaaS, and similar innovations.

Product and Service Innovation

This category showcases innovative products and offerings, developed independently or through collaborative partnerships, that match customers’ evolving digital lifestyles to foster sustainable growth. These include breakthrough concepts that dramatically enhance, transform, or tailor the banks’ offerings to specific market segments across products such as deposits, credit, payments, investments, and advice.

Business Banking Innovation

This category recognizes banks that are driving breakthrough corporate banking innovation and digitization across channels, cash management, payments, treasury, trade finance, and similar areas. It showcases banks driving such digital innovation to deliver tailored, efficient solutions enabling large corporates, mid-sized businesses, and SMEs.

Predictive, Generative, and Agentic AI Innovation

This category recognizes banking initiatives with pioneering AI-driven solutions driving substantial value and business outcomes. It includes initiatives leveraging emerging AI technologies like predictive analytics, generative AI, and agentic AI. The focus is on how these AI capabilities are applied to optimize operational efficiency, enhance decision-making, deliver superior customer experiences, and drive innovation.

Operations and Workforce Transformation

This category awards banks that have successfully navigated complexities with process re-engineering and operations, laying groundwork for profitable growth. Initiatives cover scalable processes that drive efficiency to support faster growth for bank’s revenue stream and asset base than for its overhead costs. The category also recognizes pioneering transformative initiatives that empowers their workforce. These projects cover transformation of workforce, employee...

Customer Experience Innovation

This category showcases initiatives that leverage a variety of digital technologies to effectively engage clients, fostering a customer-centric approach that elevates loyalty, satisfaction, and advocacy. This includes significant enhancements in the bank’s marketing, sales and distribution, including physical distribution. It also captures management of customer channels, communications, engagement and relationships – both digital and physical.

Social, Sustainable & Responsible Banking Innovation

This category honors banks that are inspirational in their approach to ESG within their organization and in the development of appropriate customer offerings to meet these emerging needs. This includes innovations that advance the bank’s social purpose and its commitment to being a good corporate citizen and a true ally of its customers in their journey.

Emerging Tech Innovation of the Year

Innovations leveraging modern technology. The convergence of game-changing technologies such as Cloud, Gen AI, Blockchain, Open APIs, IoT, and Mixed Reality brings our imagination of tomorrow’s banking to life. Better technology is always at the heart of every organization’s quest to provide future-ready offerings. This particular award will recognize banks that inspire better banking by architecting the future by making...

Last but not least... special awards category for 2025

TRANSFORMATIVE INNOVATOR OF THE YEAR

The winner is a bank or banking group that has successfully achieved a best-in-class transformation approach to create and deliver tangible value. Their corporate vision also commits it to continuous innovation and a journey of digital transformation to ensure the organization remains relevant, agile, and capable of adapting to the ever-evolving business landscape. You cannot submit your innovation in this category. There is a separate application form, and you must have submitted at least three innovations in any of the other seven categories to qualify.

Our judges

Bartosz Zborowski

Bank Pekao

Head of Digital Sales and Service Department

Sami Huovilainen

Citi USA

Managing Director, Head of Next Gen Analytics

Marta Martínez López

Banco Cooperativo

Head of Innovation

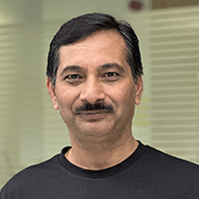

Parag Gupta

Zand Bank

Chief Operating Officer

We're back!

Get in touch

Want to get in touch regarding the submission process or invitations? Please write us at innovation@qorusglobal.com

Open Q&A session on how to succeed with your submission

Meet the awards team

Boris Plantier

Qorus

Head of Content & Awards

Petra Balazova

Qorus

Awards Project Manager

Latest Innovations

- 20/06/2025Banking Innovation

Agric Financing

The small scale farmers in Cameroon constitute majority of membership of close to 92% financial institutions. These institutions has built...

- 15/06/2025Banking Innovation

XPeriment Innovation Platform

SAB Bank's platform to rapidly engage with technology partners, global & Saudi Fintechs to help accelerate validation of ideas and...

- 14/06/2025Banking Innovation

Income Advance

Pockit’s Income Advance offers an affordable, inclusive solution for low-income and underbanked consumers. It provides instant access to short-term credit...

- 14/06/2025Banking Innovation

mBank wrapped - a year-end wrap-up

In 2025, mBank - following the example of companies like Spotify, Duolingo, and Strava — prepared a dynamic, information-rich, and...

- 12/06/2025Banking Innovation

Try out new banking services in augmented reality!

AR banking on Apple Vision Pro: Visualize travel deals, check balances spatially, and virtually try on sneakers, all within your...

- 12/06/2025Banking Innovation

Mini App Partnerships within My Life with İşCep

We have been transforming İşCep into a personalized finance and lifestyle app. With mini apps on the My Life with...

- 12/06/2025Banking Innovation

Instant Vehicle Loan

Instant Vehicle Loan is a fully digital, time-saving solution that lets our customers apply for and use vehicle loans through...

- 12/06/2025Banking Innovation

MAF Share Credit Card - Product Launch

The Emirates NBD Majid Al Futtaim (MAF) Share Card launch, featuring the "Beat It" campaign, revolutionized retail shopping. Offering an...